Top 7 Takeaways: SBA Payroll Protection Program (Coronavirus Disaster Loans)

SBA Payroll Protection Program (Coronavirus Disaster Loans)

There are several disaster loan provisions related to Coronavirus. The SBA Payroll Protection Program is part of the CARES ACT signed into law on March 27, 2020.

Here is a great article on the topic:

Think the CARES Act Money Will Come Quickly? Don't Count on It

LINKS TO SBA Resources:

Paycheck Protection Program FAQs for Small Businesses

SBA Paycheck Protection Program (PPP) OVERVIEW

This is really sweet deal for those who are eligible. Here are the salient points:

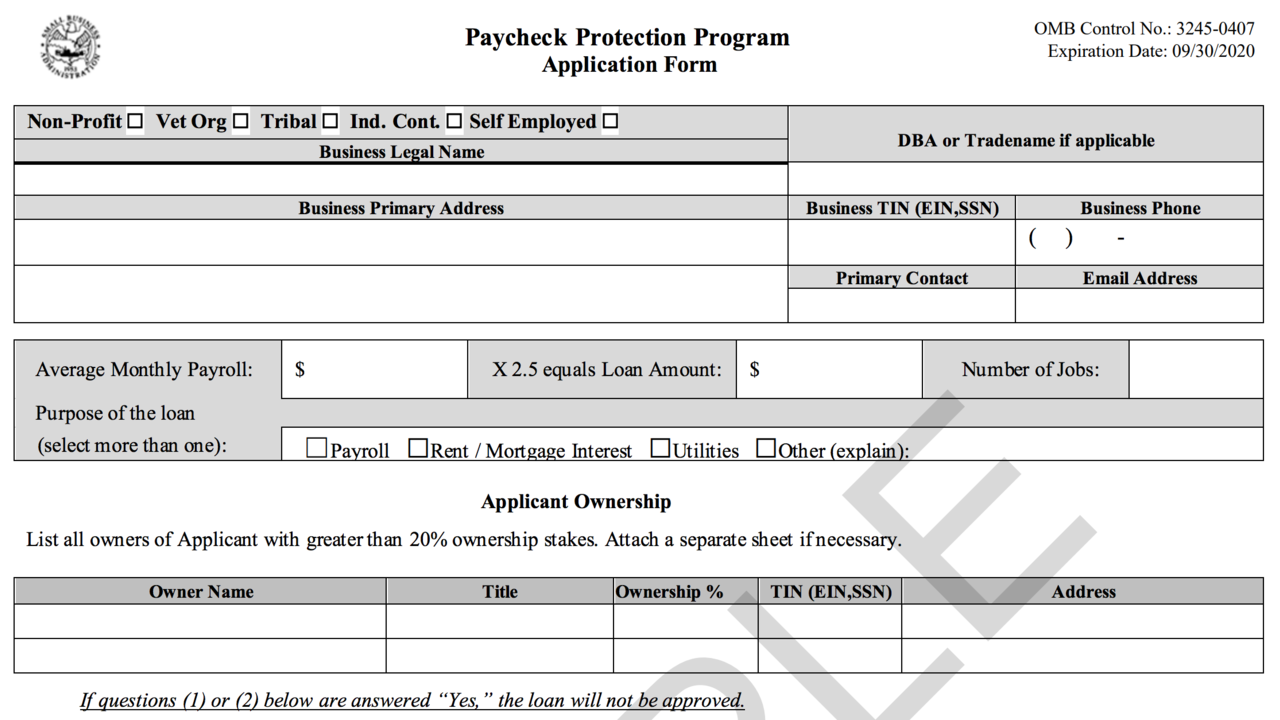

1) Your business can get a loan mainly to cover payroll expenses with a pretty simple application as far as applications go.

Paycheck Protection Program Application Form (SAMPLE)

Review the app and gather all info so you can be ready to go on April 3, 2020 when the program starts. (There will be a long virtual line)

2) The loan amount is 2.5X the average monthly payroll for 2019 (this is the case for most businesses; SEE the FAQs for nuances)

Refe...

Coronavirus Stimulus Checks (The CARES ACT)

Relief finally!

Congress passed a record breaking $2T stimulus package. The thing people care about the most are the Coronavirus Stimulus Checks.

Yes, the US Treasury is issuing checks to taxpayers so everyone wants to know:

1) When do I get my check?

2) How much am I getting?

Regarding when? Here is an optomistic take:

Howver, treasury can only issue so many checks in a given week (system limitation) and the IRS is short handed from budget cuts.

It's better to mentally prepare for 1-2 months based on past history from 2001 and 2008 and considering government capacity.

Regarding how much there are several moving parts:

- Single with income up to $75,000 > $1,200

- Single with income $99,000or greater > $0 (phase out inbetween)

- Married (no kids) income up to $150,000 > $2,400

- Married (no kids) income greater than $198,000 > $0 (phase out inbe ...

Coronavirus Tax Relief (Links to Dept of Revenue for ALL 50 States)

Dept of Revenue Links by State

Many states have created dedicated webpages to address special Coronavirus tax relief on the state level. The links are posted on the Dept of Revenue homepage and we also included links to the Dept of Revenue that don't have a dedicated page becuase they may create one in the future and you can access it from here.

In addition, the state may post COVID19 relief on their Dept of Revenue page rather than creating a dedicated page.

Massa...

Top 5 Tips for a Headache-Free SBA Coronavirus Disaster Loan Application

Let's face it every business owner despises forms and applications especially when it comes to loans and money. Couple that with unchartered territory related to the Coronavirus and you may have an ultra low band width to complete the form.

Here are the Top 5 TIps to get the form complete as fast as possible with the fewest headaches.

- APPLY for Disaster Loan HERE

- CHECK Current Declared Disaster Areas HERE

- QUICK Summary of Terms is HERE

- SMALL Business size standards can be found HERE

TOP 5 Headache-Free Tips:

1) START at the right time of day or night:

Per the SBAs own application portal the recommended hours to complete the application are 7am to 7pm EST or 10am to 10pm PST. This warning is true because we pulled our hair out attempting this the first time.

You may get into the application process but you are likely to get kicked out and have to start over. Don't put this stress on yourself. (see screenshot of hours below). You are also constantly prompted to click the sa...

3 Takeaways: IRS Coronavirus Tax Relief Automatic EXTENSION

The IRS officially announced (on 3-21-20) an AUTOMATIC Extension of the April 15, 2020 tax deadline for 3 extra months until July 15, 2020.

Here are the 3 key takeaways:

1) Filing a tax return on time and making tax payments on time are two separate and distinct actions by the taxpayer. The extra 3 months extension extends both of these things. FIling tax returns and tax payments are BOTH extended 3 months.

PAYMENTS:

- Individual tax payments due on 4-15-20 are NOW due on 7-15-20

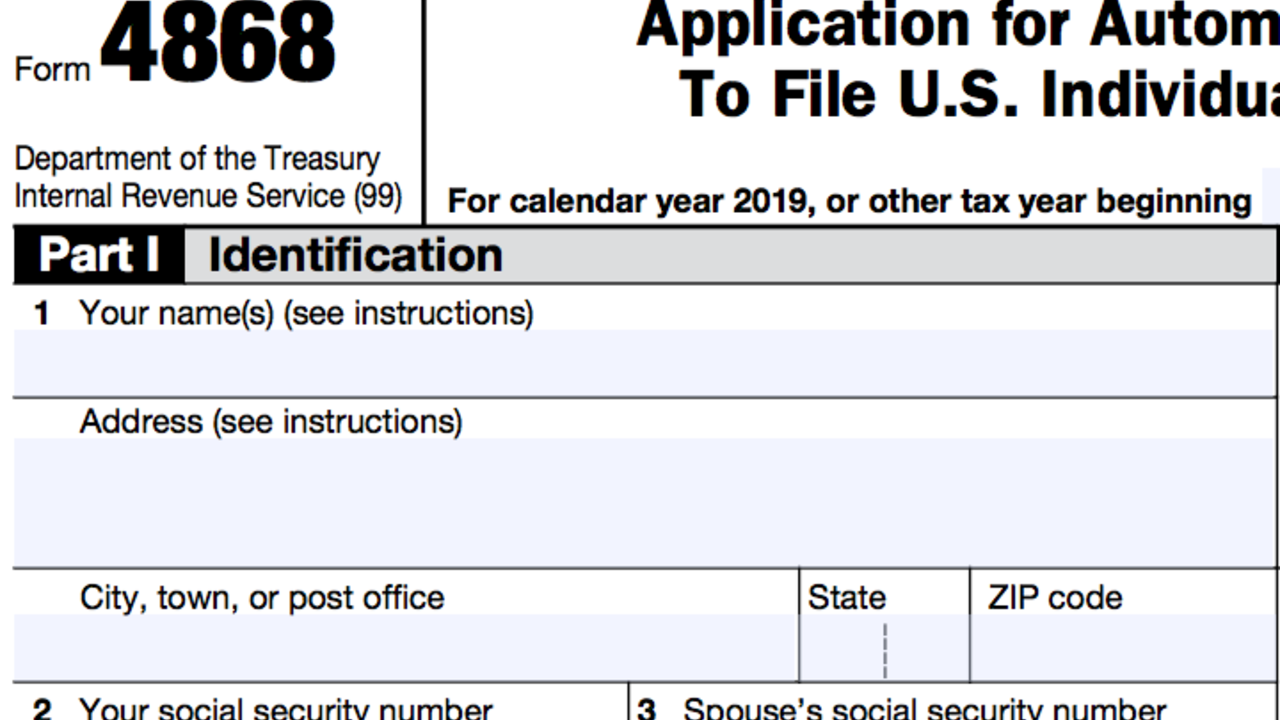

- Applies to 2019 extension payments (Form 4868) that WAS due on 4-15-20

- Applies to the 1st 2020 estimated payment that WAS due on 4-15-20

2) The new July 15, 2020 Extension applies to BOTH individuals and businesses:

- Corporations, partnerships, LLCs, estates, trusts (and other non-corp filers)

- Individuals as stated above

- If July 15, 2020 rolls around and you still need more time then file an extension at that time:

- INDIVIDUAL EXTENSION: Form 4868

- BUSINESS EXTENSION: Form 7004

3) If you expe...

IRS Closes Taxpayer Assistance Centers "until further notice"

The IRS announced this over the weekend: (see also link below)

Take away: Don't confuse this with a full operational shutdown. The IRS is otherwise in as high gear as possible at the current time.

"In response to the national emergency and to protect our employees, America’s taxpayers, communities and our partners, the IRS has temporarily closed all Taxpayer Assistance Centers and discontinued face-to-face service throughout the country until further notice. The IRS is continuing to process tax returns, issue refunds and help taxpayers to the greatest extent possible. Click here for more info on taxpayer assistance center closures."

"The IRS is continuing to process tax returns, issue refunds and help taxpayers to the greatest extent possible. Taxpayers are highly encouraged to go to IRS.gov and to the newly created IRS.gov/coronavirus webpage where they can find the latest updates about IRS services, explore free options to file or request an extension to file at www.IRS.gov/freef...

The Seven Secret Weapons for Crushing a SIM Card Attack

BLOG COMING SOON!

In the meantime go here to get notified about this super important topic.

Top 5 Things:

What is Bitcoin Used For?

_11-11-16.jpg)

What is bitcoin used for? The top 5 answers show how bitcoin is our modern day financial super hero. Bitcoiners may vary on their top things, but all uses are a break with the rusty old rail banking system. There are an infinite number of financial and non-financial use cases and five practical applications make bitcoin a powerful choice.

Use #1) International Remittances

Cross border payments are a multi billion-dollar industry scraping off about 10% in fees for every dollar transferred. I wrote a chapter in my book, The Ultimate Bitcoin Business Guide, called Money Transfer Madness™ to describe the insanity of this non-value added service. Similar to Credit Card Chaos™, Money Transfer Madness™ can have 8 or more parties in the transaction each grabbing some fees along the way which don't justify the value of the service anyway you slice it.

Elimination

A reasonable person will tell you a fair price is 1-2%, but 5 to 10 times your hard earned money goes to waste. Bitcoin prove...

Super Nova: What is a Bitcoin Worth?

_10-25-16.jpg)

Asking what is bitcoin worth and what is the price of bitcoin are not the same question. Securities markets are considered highly efficient yet investors find and buy stock in undervalued companies all the time. An efficient market is one where the price matches the value because all information is reflected in the price. Bitcoin worth is not reflected in the price of bitcoin. There's a whole range of people who value bitcoin much higher than its price so now is a great time to buy bitcoin before the market catches up to itself.

Disclosure

I'm a Bitcoin Evangelist so I'm very biased towards bitcoin being undervalued. Bitcoin is impossible to price accurately because it's true potential has yet to be realized. An infinite number of use cases will continue to provide value as they are rolled out and deployed over the coming years. The birth of altcoins, appcoins and fundamentally new protocols are proof of an accelerating expanding Bitcoin Universe.

Price

The price of bitcoin can...

Banks to Bitcoin:

If You Can't Beat 'em

Join 'em

10-7-16.jpg)

The Bitcoin Blockchain is known as The Blockchain and all other blockchains need qualification such as The Ethereum Blockchain, The IBM Blockchain or The Dutch Central Bank Blockchain and so on. You don't need to add the word Bitcoin to the phrase The Blockchain because Bitcoin reserves the right as the godfather of all cryptocurrencies. The technology is getting repurposed to an infinite number of mind-blowing applications while most folks around the world are just finding out about Bitcoin. Blockchains are one source for an entire record of activity.

Everyone's Blockchain

The cyrptocurrency headlines over the past 12 months have been filled with big banks and big businesses investing millions in blockchain projects and consortiums of like minded players. Less than a year ago Big Four accounting firms, the DTCC, banks and many others had a few boots on the ground reporting back about this cool blockchain thing that could saves lots of money. Now all these organizations have their...