Top 7 Takeaways: SBA Payroll Protection Program (Coronavirus Disaster Loans)

SBA Payroll Protection Program (Coronavirus Disaster Loans)

There are several disaster loan provisions related to Coronavirus. The SBA Payroll Protection Program is part of the CARES ACT signed into law on March 27, 2020.

Here is a great article on the topic:

Think the CARES Act Money Will Come Quickly? Don't Count on It

LINKS TO SBA Resources:

Paycheck Protection Program FAQs for Small Businesses

SBA Paycheck Protection Program (PPP) OVERVIEW

This is really sweet deal for those who are eligible. Here are the salient points:

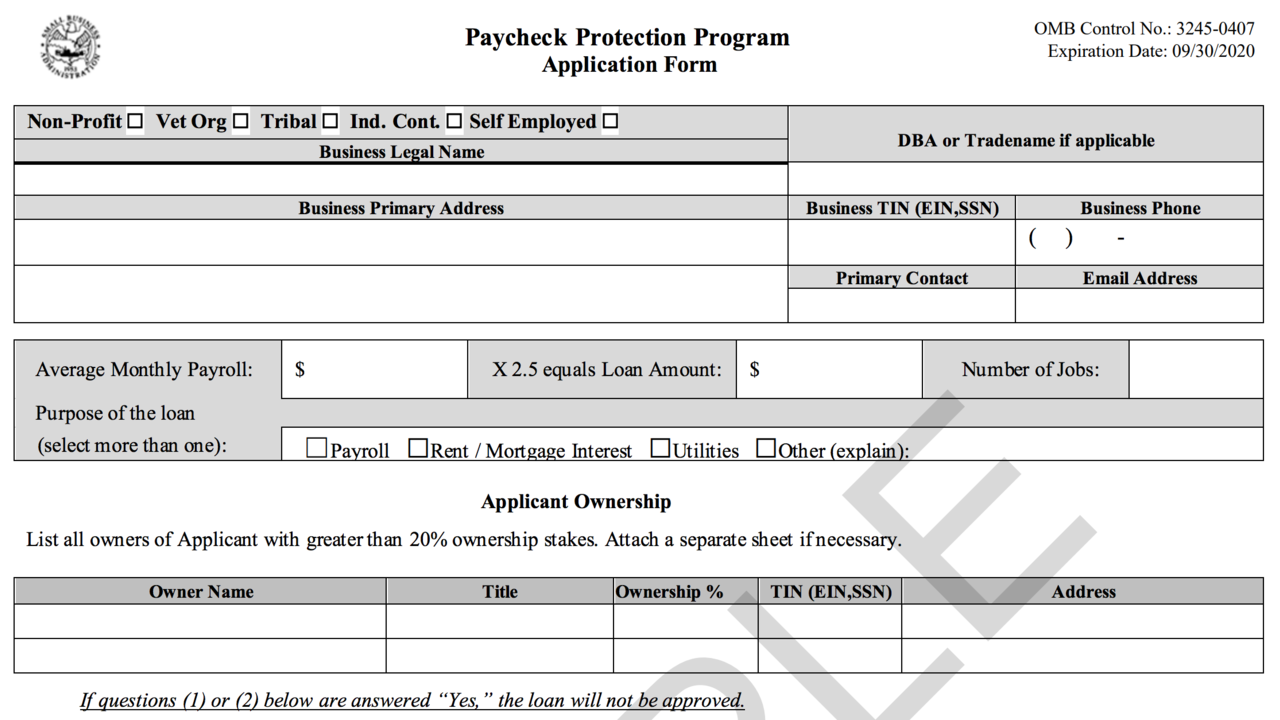

1) Your business can get a loan mainly to cover payroll expenses with a pretty simple application as far as applications go.

Paycheck Protection Program Application Form (SAMPLE)

Review the app and gather all info so you can be ready to go on April 3, 2020 when the program starts. (There will be a long virtual line)

2) The loan amount is 2.5X the average monthly payroll for 2019 (this is the case for most businesses; SEE the FAQs for nuances)

Refer to the total payroll on IRS Form W-2 or the total of the 4 quarterly IRS Forms 941. Then divide by 12 and multiply by 2.5 and that is your loan amount.

3) The loan can be FORGIVEN (Yes I had to rub my eyes a few times as well) The loan has to be used for payroll, rent, leases and utilities to qualify (75 must be for payroll)

4) The loan proceeds have to be used for an 8-week period to qualify for forgiveness.

Here is the related FAQ: What is the covered period of the loan? The covered period during which expenses can be forgiven extends from February 15, 2020 to June 30, 2020. Borrowers can choose which 8 weeks they want to count towards the covered period, which can start as early as February 15, 2020.

5) APPLICATIONS start on April 3, 2020. Go to the PPP Overpage above.

6) Where to apply? This is done via SBA approved lenders the same as for 7(a) loans. PPP loan is not processed via the SBA sight. There will be high demand and which ever lender to pick may determine how fast you get the loan.

Here is the FAQ: Where can I apply for the Paycheck Protection Program?

You can apply for the Paycheck Protection Program (PPP) at any lending institution that is approved to participate in the program through the existing U.S. Small Business Administration (SBA) 7(a) lending program and additional lenders approved by the Department of Treasury. This could be the bank you already use, or a nearby bank. There are thousands of banks that already participate in the SBA’s lending programs, including numerous community banks. You do not have to visit any government institution to apply for the program.

You can call your bank or find SBA-approved lenders in your area through SBA’s online Lender Match tool. You can call your local Small Business Development Center or Women’s Business Center and they will provide free assistance and guide you to lenders.

NOTE: As of 4-1-20 The Match Tool link goes to the Payroll Protection Program OVERVIEW page.

7) The BEST for Last: There is no personal guarantee, no limit on time in business and no collateral needed.

We will update the status as the PPP rolls out.