3 Takeaways: IRS Coronavirus Tax Relief Automatic EXTENSION

The IRS officially announced (on 3-21-20) an AUTOMATIC Extension of the April 15, 2020 tax deadline for 3 extra months until July 15, 2020.

Here are the 3 key takeaways:

1) Filing a tax return on time and making tax payments on time are two separate and distinct actions by the taxpayer. The extra 3 months extension extends both of these things. FIling tax returns and tax payments are BOTH extended 3 months.

PAYMENTS:

- Individual tax payments due on 4-15-20 are NOW due on 7-15-20

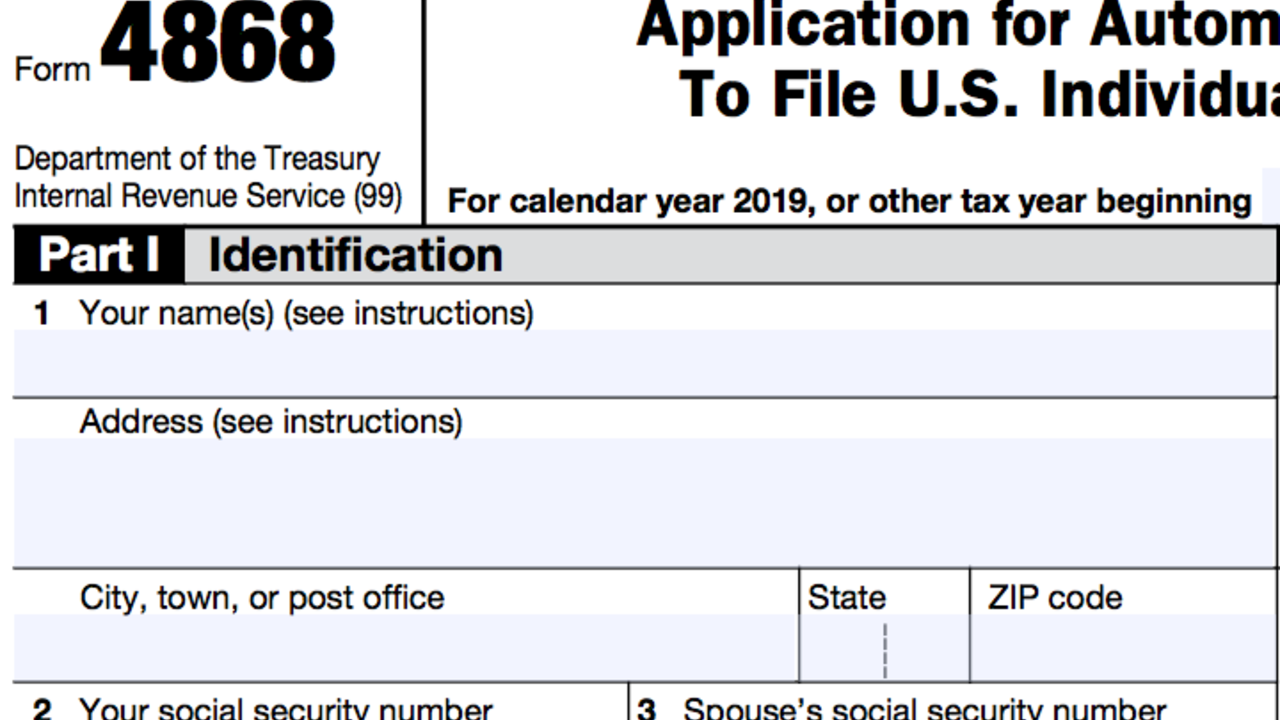

- Applies to 2019 extension payments (Form 4868) that WAS due on 4-15-20

- Applies to the 1st 2020 estimated payment that WAS due on 4-15-20

2) The new July 15, 2020 Extension applies to BOTH individuals and businesses:

- Corporations, partnerships, LLCs, estates, trusts (and other non-corp filers)

- Individuals as stated above

- If July 15, 2020 rolls around and you still need more time then file an extension at that time:

- INDIVIDUAL EXTENSION: Form 4868

- BUSINESS EXTENSION: Form 7004

3) If you expect a refund dont delay and file right away. If you typically make estimated payments this is a very welcome RELIEF.

- File electronically for the fastest possible refund. If you file today it could be 4 weeks before you can use the cash depending on the timing of payment on weekends and holidays.

- IRS service centers are closed for face to face contact as mentioned here:

- If a significant number of IRS workers become ill from coronavirus and cant work then refund processing could be delayed. Lot's of folks are going to have major cash flow problems so time is of the essence. If you think you are one of those people or business owners then file ASAP.

- REFUNDS can be checked here.

READ more here: https://www.irs.gov/newsroom/tax-day-now-july-15-treasury-irs-extend-filing-deadline-and-federal-tax-payments-regardless-of-amount-owed